florida estate tax limit

Federal Estate Tax As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. A person may be eligible for this exemption if he or she meets the following requirements.

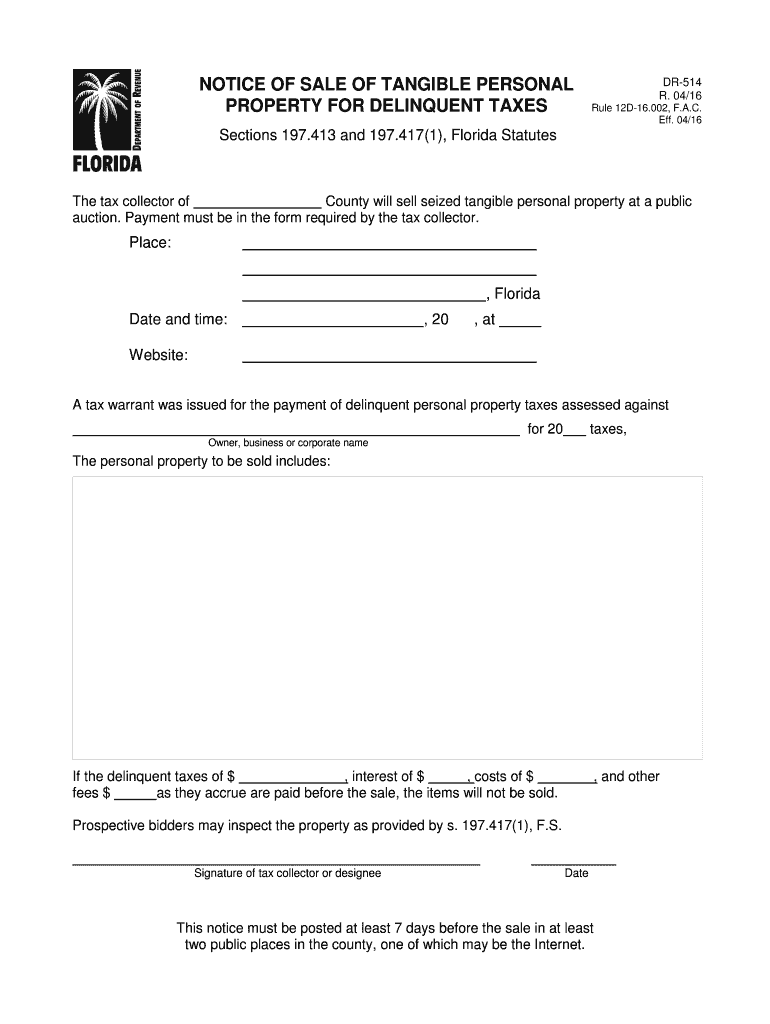

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

This assessment cap is only for non-homestead properties that is all properties that DO NOT have a homestead exemption such as 2nd homes rental properties vacation homes vacant land or commercial property.

. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. The two year limitation on creditors. By Kulas Crawford Florida Law Firm Website.

1 Any funds after that will be taxed as they pass on to heirs at a rate that varies by the amount being passed on. This exemption qualifies the home for the Save Our Homes assessment limitation. Want to get a head start on the probate process.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Owns real estate with a just value less than 250000 Has made it his or her permanent residence for at least 25 years Is age 65 or older Does not have a household income that. The first step towards getting probate opened is completing our online Intake Form.

Estate in Florida with a just value less than 250000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence on the property for at least 25 years is 65 or older and whose household income does not exceed the household income limitation. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. For additional information refer to Instructions for Form 706.

If an estate is worth 15 million 36 million is taxed at 40 percent. The pro rata portion of the estate tax due Florida is determined by the following formula. Pursuant to the Internal Revenue Code you are not required to file an estate tax return as a personal representative unless the value of the decedents estate exceeds the annual threshold as established by Congress.

To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40. With the estate tax level so high which doubles to 2412 million for a married couple very few peopleestates need to worry about the federal estate tax. 10 Cap Assessment Limitation for Non-Homestead Property.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. There is no inheritance tax or estate tax in Florida. For decedents that died more than two years prior to their estate going through probate no debts should will be paid because all claims are barred pursuant to Florida Statute section 733710.

Proper estate planning can lower the value of an estate such that no or minimal taxes are owed. Federal estate tax return due nine months after the individuals death This is required only of individual estates that exceed a gross asset and prior taxable gift value of 114 million Automatic six-month extensions are given if asked for prior to the conclusion of the aforementioned nine-month period. Gross Value of FL Property 1 X Federal Credit for State Death Taxes from Form 7062 Florida Estate Tax Gross Value of Entire Estate or 3 1Florida property is Florida real property tangible personal property located in Florida stock of Florida corporations or certain other intangible personal.

Even though Florida doesnt have an estate tax you might still owe. Assuming you have not added any new construction to your Homestead property your assessed value cannot increase more than 14 percent in 2021. Luckily there is no Florida estate tax.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the propertys taxable value by as much as 50000. The 10 cap applies to all taxing. As noted above the federal estate tax rate can climb to 40 depending on the size of your taxable estate.

This year the maximum increase on the assessed value of a Homestead property in Florida has been capped at 14 percent. 13 rows Federal Estate Tax. Important Dates Local Governments That Levy Taxes.

Florida does not have a state estate tax. 260000 Assessed Value - 50000 Exemption 210000 Taxable Value x 011 Millage 2310 Tax Liability Total Taxes School Tax Liability Non-School Tax Liability 3955 1645 2310 More information is available on our Exemptions page. The assessed value of the property.

For the 2011 tax year the estate tax filing threshold is 5 million. 3 Oversee property tax. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

In addition the state doesnt. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021.

The 10 cap became effective beginning with the 2009 tax roll. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries. Furthermore the federal estate tax only applies to multi-million-dollar or billion-dollar type estates and affects less than 1 of the country.

But if you transfer an estate valued at something higher than that upon death the federal government can tax a portion of the estate you leave behind before its transferred to the designated heirs.

Florida Estate Tax Rules On Estate Inheritance Taxes

Here S How Many People Pay The Estate Tax

Florida Property Tax H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Attorney For Federal Estate Taxes Karp Law Firm

Florida Real Estate Taxes What You Need To Know

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm